This article explains how a practicing advocate may enroll his / herself online on the website of the Profession Tax authorities in Maharashtra.

This article may also be useful for Doctors, Chartered Accountants (CA), Architects, Engineers and all other persons subject to Profession Tax in Maharashtra, to enroll.

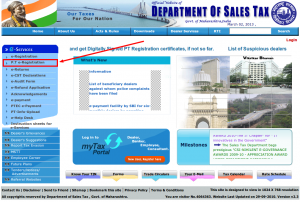

Step 1: Go to the website: https://mahavat.gov.in and click on PT e-registration on the left menu.

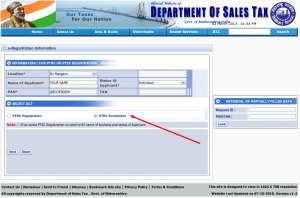

Step 2: Fill in the details

Fill in the following details:

- Location (The closest profession tax office)

- Name of the Applicant (Your full name)

- Status of the Applicant (Select Individual)

- PAN Number

Select the PTEC (Profession Tax Enrollment Certificate) Enrollment option

Click Next

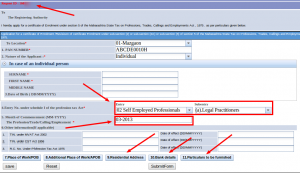

Step 3: Fill up other details

IMPORTANT: Note the Request Id Number on the top, which gets generated when you fill up your details.

It will be important to retrieve a form which is half-filled or which disappeared half-way.

Fill up all information which is required.

- In Entry, enter 02 Self Employed Professionals

- In Subentry, enter (a) Legal Practitioner (Obviously, if you are from a different profession, you will fill up this field appropriately)

- Enter the month of comencement of practice, as given on your Bar Council ID Card. (Profession Tax is payable from this date onwards)

Step 4: Enter Additional Details

- Enter your Residential Address, by clicking on the button “9. Residential Address”

- Enter your Bank Account details in full

- In Particulars to be furnished, in Entry No. input “02” (Entering just 2 will not help)

- In the particulars field, enter your Bar Council Enrollment Number

Review the form incase you want to make any changes.

Step 5: Submit the Form

You need to click the submit button to submit the form.

This will generate an acknowledgement with the time, date and place you need to be present to submit the supporting documents.

You can send any person to that address, or go your self with the following documents:

- Print out of the form you just filled in

- Print out of the Acknowledgement Token

- Copy of your PAN Card (self-attested)

- Copy of your Bar Council ID (self-attested)

- Copy of your Bar Council Certificate (self-attested)

- Copy of any one Residential Address proof (self-attested)

- Copy of any Business Address proof (self-attested) if applicable

- One Blank Cancelled Cheque of the Bank Account for which the details were given.

Don’t forget to take an acknowledgement of the form, on a photocopy.

Step 6: Wait for your enrollment certificate and number.

The PT certificate is sent by post within a month or so.

Using this number you will be able to pay your profession tax.

To find out your Profession Tax Number before you receive your certificate read this article.